When is an acquisition not an acquisition? The short answer is when French waste and water giant Veolia agrees to buy the shares of its smaller – yet still large – rival Suez in what it calls a “merger”.

The bald facts are though that Veolia agreed on Sunday 11 April 2021 to acquire the shares in Suez which it didn’t own. It agreed to pay 20.5 Euros a share, which is thought to be the highest value ever achieved or offered for Suez shares and the two businesses, going forward, will have total revenues of around 37 billion Euros. Veolia already owned 29.9% of Suez having bought that stake from Engie last year.

Clearly the deal is more of an acquisition even if in Paris it is portrayed by Veolia as an agreed coming together. A sign that a ‘merger’ was not intended, at least from the Suez point of view, came with its attempts to throw a spanner in the works of any acquisition through proposed sell-offs and unusual share structures. One of these was creating a foundation in the Netherlands which would have a share in Suez and which could accordingly scupper Veolia’s attempts to buy the business.

But then, with the 20.5 Euros share offer, peace broke out. Suez chairman Philippe Varin declared that the offer recognised the value of Suez. Chief executive Bertrand Camus referenced the idea of the deal creating a “global solution” – a vision which has been developed by Veolia in all its courting of Suez.

The agreement marks the end of one of the longest courtships in the waste sector – around the year 2000 there were the first modern era talks of Veolia merging with Suez.

‘Beneficial’

The words of Veolia’s Antoine Frérot from 12 April this year are revealing in many ways, most notable with reference to ‘world champion’. Mr Frérot said: “I am particularly pleased to announce today the conclusion of an agreement between SUEZ and Veolia that will enable the construction of the world champion of ecological transformation around Veolia, offering France a reference player in a sector that is probably the most important of this century. This agreement is beneficial for everyone: it guarantees the long-term future of SUEZ in France in a way that preserves competition, and it guarantees jobs. All stakeholders in both groups are therefore winners. The time for confrontation is over, the time for combination has begun.”

“I am rational like Machiavelli”

From this declaration of harmony, Mr Frerot lays store on Veolia’s global ambitions linked to the world’s recognition of the need for ‘ecological transformation’ – linked to the need to tackle global warming with emissions reduction. He also points to the creation of a French ‘reference player’ and it is on this point that the French government is seen as also being in full support. Despite some moves by French authorities, French ministers are privately expected to be delighted and proud that the country will have a giant ‘sustainability’ enterprise to act strongly on a global scale.

The success of the sale has a personal dimension for Mr Frerot. In an interview in Paris with the Financial Times on 16 April, he was asked about the tough stance the company had taken in its pursuit of Suez. Mr Frerot remarked: “Machiavelli said that he who wants the end, accepts the means… I am rational like Machiavelli.” One definition of Machiavelli’s approach from Wikipedia, is that “Machiavelli considered political battles, not through a lens of morality, but as though they are a board game with established rules.”

Certainly Veolia viewed its bid to secure Suez as a battle with stages where actions were taken to try and ensure that Suez could not move in ways which might jeopardise an acquisition.

Powerplay

So, how much is the deal a French powerplay rather than a development involving the UK?

At the top level the acquisition or merger is hardly anything to do with the UK. It has been a French agreement to sell and buy although both businesses will know the UK well. Veolia in particular has UK knowledge at the very top in Paris with the chief operating officer, Estelle Brachlianoff, a former vice president of Veolia’s UK and Ireland business.

But, despite the importance of the UK, ahead of the sale it was seen as just a territory of activity for both businesses forming part of the whole.

Any Anglo-Saxons who would want a say in the merger are likely to have been disappointed but they will now get the chance to have their say as the two businesses await preparations to join up. The date of the final coming together is still to be confirmed, but in a recent video interview with Bloomberg, Mrs Brachlianoff suggested that this autumn is possible.

Full planning on how the coming together will be organised is limited because of competition concerns. In the UK the Competition and Markets Authority has already stepped in with a requirement for the two businesses to remain apart. Steps thought are being taken by Veolia and Suez to smooth the way with competition authorities globally. An early indication of clearance has come in the United States and in France, to counter domestic concerns there over dominance of the water sector, a new reduced ‘Suez’ business, with revenues of seven billion Euros will be created and take on some divested water activities from the two companies.

Water and waste

In France the two have always been seen primarily as water businesses with waste interests, whereas in the UK the situation is now different with little water involvement but waste the big activity.

In the UK, the acquisition of the Suez business will catapult Veolia further away from its competitors. Currently Veolia Environmental Services (UK) has an annual turnover in the waste sector of c£1.8 billion and with Suez UK c£784 million the new business will be well ahead of the field.

The big question for those in the UK will be ‘will the CMA act to restrict the deal in the UK?’

To those close to the companies and beyond, the general view seems to be ‘no’ and that the merger will be allowed to happen. That isn’t to say that there might be a requirement to divest a particular plant or even contracts, but there is a consensus that the activities of the pair are broadly complementary.

Nevertheless, concerns will be raised by some UK waste and recycling businesses and potentially local authorities about a perceived reduction in competition and the creation of a massive waste and resources business which will have a huge momentum.

Past mega-deals in the waste sector have usually gone through the competition process albeit with some actions required and acquisitions have played a big part in Veolia’s UK growth.

Cory Onyx

Veolia first landed in the UK in the early 1990s as Onyx in a partnership with with Cory (now Cory Riverside Energy). As Cory Onyx it made tentative steps in the UK before Onyx became its own business and brand.

Growth first came in 1993 with securing of the Birmingham Tyseley incinerator contact and then in 1995 Onyx won the long-term Hampshire PFI work, raising its turnover to around £100 million per annum.

The first notable acquisition came with the purchase of Leigh Interests in 1997 increasing the activity of the Onyx business in the commercial and industrial sector and raising its turnover to around £600 million.

In 2000 the company had its first brush with Suez (then known as SITA) with Onyx Environmental Group ‘shaken up’ against a background of failure to win the Surrey contract (see letsrecycle.com story).

And, it was perhaps because of this loss, that time Veolia as Onyx first discussed acquiring Suez, an idea which was to surface at various points right up to 2020.

AstraZeneca

On the ground in the UK, better contract news came in 2001 when Onyx secured the Sheffield contract as well as an industrial waste contract for AstraZeneca which it still holds today as Veolia (see letsrecycle.com story)

In subsequent years Onyx grew steadily in the local authority market: in 2002 it made inroads in London where it secured more work for Westminster and new work for Camden. But, it was clearly still learning the geography of the UK as the company made an early exit in 2001 from a contract with High Wycombe council, saying it didn’t realise the town was so hilly (see letsrecycle.com story). Last year Veolia appeared to have improved its knowledge of the area by tendering for – and winning – the High Wycombe work as part of a £10 million contract with three Buckinghamshire councils.

Cleanaway

At the start of 2006 Onyx Environmental Services became Veolia Environmental Services and the year was also very significant in that the company was to double in size. The year 2006 was to bring growth which is almost on a scale in UK market terms to the current acquisition by Veolia of Suez. 2006 saw the company buy the Cleanaway UK waste management business from its parent Brambles for £589 million (see letsrecycle.com story) This propelled the enlarged Veolia business to a new annual turnover in excess of £1.1 billion pulling it well ahead of Biffa which had been in third place in the municipal market.

The municipal market share in 2005 (with Veolia number 1 in the market now) was:

- Cleanaway (23.3%)

- Onyx (18.3%)

- Biffa (13.3%)

- SITA UK (now Suez UK) (11.7%)

- Verdant (7.5%)

- Cory (5%)

- Focsa (5%)

- Serco (4.2%)

- MRS/Enterprise (2.5%)

- Accord (2.5%)

Doubling

The Cleanaway purchase meant that Veolia’s coverage in the UK expanded dramatically and its workforce almost doubled from c6,500 to c13,000 – Cleanaway had more employees than Veolia. It gained a much stronger presence in the north-west of England and also materials recycling facilities in East London and Essex including a modern MRF in Greenwich. It also meant that Veolia owned the UK’s two hazardous waste incinerators – gaining one at Ellesmere Port from Cleanaway to go with its own plant at Fawley, Southampton which it had bought just a year earlier.

Cleanaway UK was one of the largest collectors of municipal, commercial, industrial and trade waste in England and Wales and operated a fleet of approximately 2,000 vehicles. Cleanaway UK’s waste disposal operations handled about 150,000 tonnes of liquid chemical waste per annum. Cleanaway UK employed around 7,500 people and operated a nationwide network of service centres and a number of active landfill sites.

Competition

It was the two high temperature incinerators which caught the eye of the competition authorities. The UK in 2006 was part of the European Union and it was the European Commission’s competition office which assessed the Cleanaway purchase and subsequently ordered Veolia to divest one of the incinerators. The Commission’s office ruled that with the incinerator sale, the acquisition did “not significantly impede effective competition in the European Economic Area or any substantial part of it”. This was a ruling endorsed by the UK’s Office of Fair Trading which raised no objections to the Veolia/Cleanaway deal. Veolia agreed and sold off the incinerator at Fawley to Pyros Environmental – a consortium comprising members of the existing management team and private equity investors.

Significantly though for the proposed ‘merger’ with Suez, there were no other restrictions (see letsrecycle.com story).

Today the Suez acquisition will be looked at by the European authorities and in the UK by the Competition and Markets Authority (CMA).

No doubt there will be some feedback to the CMA by some waste firms and also local authorities. What might it decide?

For energy from waste, where both businesses own plants, will there be a sale of facilities ordered? This would seem unlikely: there is consolidation within the EfW sector and much of the infrastructure is actually owned by local authorities under PFI contracts as reversing assets.

And, while local authorities may not like the fact that choices for tender lists will reduce, there remain a number of other businesses working at a national and regional level. Furthermore, many local authority contracts are run in-house and Teckal businesses also compete outside of their areas. One observer remarked that council contracts really operate ‘in their own right, they are unique and are all tendered so it is hard to say that there would be a monopoly as they all come to an end, usually after seven years’.

C&I concerns

Where there might be more competition concerns is on the commercial and industrial side of the UK market. It is likely that in some parts of the UK Suez and Veolia will have strong presences where they compete on C&I work. Consequently it could be expected that rival national, regional or local players may air concerns about the level of competition in their area to the CMA.

One waste industry expert remarked: “If Veolia has 25% of C&I contracts in an area where Suez has perhaps 20% then a 45% total may be seen as too much. This is added too by the fact that both businesses will be able to internalise residual waste to their own energy from waste plants.”

So, overall while little sell off of plants and sites is expected to be required with the Veolia and Suez plants seen as mostly complementary, there is the potential for specific operations on the C&I side to be assessed and disposals or restrictions imposed by the CMA.

Jobs

For Veolia the takeover of Cleanaway was a challenge. The French business had already digested Leigh Interests but that was seen as relatively smooth because of its smaller size and that Veolia hadn’t been as strong in the UK as it was in 2006.

In terms of jobs, and perhaps of relevance to today, the Veolia UK chief executive, Cyrille du Peloux, remarked after the Cleanaway deal: “There will be some redundancies, but these will not be very significant as we are growing quite rapidly,” (see letsrecycle.com story).

Today in the UK Veolia employs c14,000 people and Suez 5,600 and Veolia has 85,000 business customers. It is expected that as they ‘merge’ most jobs will remain in terms of collections and processing. Local authority contracts are generally bespoke but where there is likely to be changes is on the commercial and industrial side. Here there will be a reorganisation of rounds and there could be some depot closures along with restructuring and a revisiting of regional operational areas.

One view is that: “There will still be X amount of waste to be collected on the commercial side but it is one where efficiencies can be driven. For blue collar workers I don’t see significant redundancies, there will be a reorganisation of routes but roughly the same number of people will be needed.”

In terms of white collar workers, there is a view that “Veolia will be even-handed” in appointing some of the senior Suez people to posts. Indeed, the Veolia/Suez merger website, has declared that The success of this merger will come from the women and men forming the new group and a rigorous process will be initiated to identify talent from both businesses.

Structure

Today Gavin Graveson heads up Veolia in the UK and Ireland as Executive Vice President which includes the chief executive role. His counterpart at Suez UK is John Scanlon who took on the reins of the company in January 2020 as Chief Executive Officer.

While companies rarely have two chief executives, a structure at the top could be created to offer posts to a number of those in the Suez management team. One observer remarked that Veolia in Paris will be keen “not to rock the boat” with the UK operation as it is “so important a market to them”. They added: “Regional and central overhead savings plus savings on the C&I side in terms of jobs and other costs are expected. There may be depot closures where operations are duplicated and of course there are bound to be changes to management teams.”

Culture

The Cleanaway deal saw the issue of culture surface with strong and experienced individuals in both businesses coming together, and the newcomers from Cleanaway having to accept a French approach to business rather than the more traditional ‘British’ way of thinking which had been strengthened by their former parent, Brambles, UK/Australian roots.

It was apparent to some that Veolia was a more centralised type of business at the time whereas Cleanaway could be considered more decentralised with perhaps more flexibility on decision making.

This type of approach is seen as remaining to an extent today within Veolia with its reluctance to invest in unproven technologies such as MBT or gasification. This is something which Mr du Peloux confirmed back in 2006. Suez, in contrast, has been willing to develop new technology projects some of which have then run into problems.

Using MBT as an example, in 2006 Mr du Peloux told letsrecycle.com: “We have absolutely nothing against MBT – if our clients request it, we can offer it. We have experience of it, we have tested MBT all over the world in a very scientific way. But from an environmental standpoint – the emissions and other impacts – and from a holistic view, it doesn’t make sense.

“There are a lot of myths surrounding MBT, and when you compare the gate fee with recycling and composting facilities with energy recovery, MBT is much more expensive. In many cases MBT is not a good answer – not only is it much more expensive, you still need to deal with the residue through landfill or by building energy recovery facilities.”

The message from Mr du Peloux was that traditional energy from waste was often the best solution for residual waste and today Veolia has stuck to this approach. It has not caught up in the difficulties that for example, the gasification sector has faced. Suez, in contrast, has gone down this route and is facing a legal wrangle in Surrey over its plant there which is still not fully operational. Suez has also looked at plastics to diesel technology with involvement in a plant developed at Avonmouth but then which failed to proceed.

Suez UK

As Suez UK is French-owned, it would seem logical that it would be easier in cultural terms for the businesses to come together than was the case with Cleanaway. Some observers feel however that Suez UK has more of a ‘northern European’ and ‘less averse to risk’ approach to business in contrast to the more cautious approach from Veolia. This is put down in part to the input of former long-serving chief executive David Palmer-Jones who became UK chief in 2008 having joined Suez (formerly SITA) back in 1989. He brought with him a range of experiences, including time in Sweden, and managed to sprinkle some none-French thinking to the UK operations to complement the French input.

Overall though, those who know the companies feel that while Suez is a large entity, the Veolia culture will soon dominate. One remarked that “Cleanaway dominated for a while because of their size but eventually it went.”

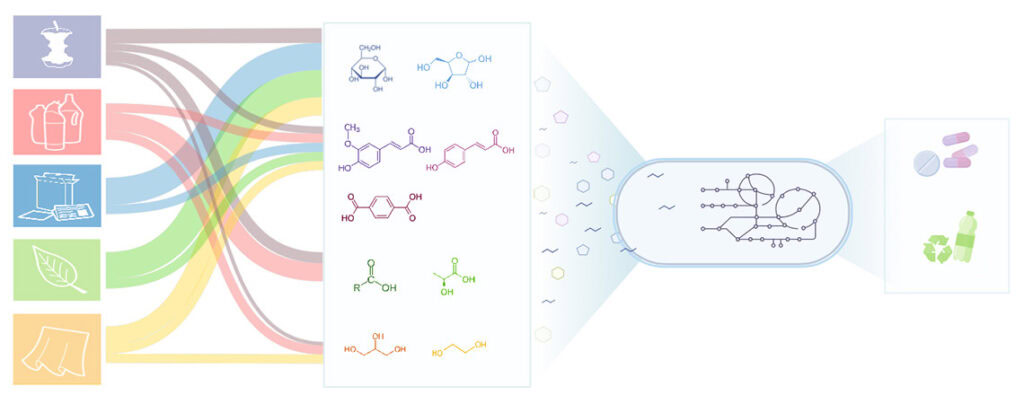

Circular economy

It may take two years or more to absorb Suez but for Veolia in the UK one thing is a certainty, it will move down the path of providing for a circular economy and sustainability in resources and waste management.

Both businesses handle substantial tonnages of material for recycling ranging across the material streams.

Plastics is a current focus in terms of sustainability and has always been a material where scale is important. The sheer size of the merged business will mean that it will have even more volumes, especially on the plastics side, to meet demand for recycled polymer material.

If any reminder was needed as to how important the company sees the Circular Economy there is the fact that Veolia were first, or at least one of the first, to push this approach to waste and have done so for eight years or more. It was Mrs Brachlianoff back in 2013 spoke of how Veolia UK was switching from being a waste management and recycling company to one that manufactures products for the circular economy (see letsrecycle.com story).

Energy from Waste plants will remain a core part of the new business and can be expected to internalise a lot more waste as well as having even greater strength in knowledge of operational efficiencies. Veolia UK has said it aims to have just two landfills, one in the north and one in the south. With Suez it will have more and so this is one ambition which is unlikely to be met.

Both businesses also have materials recycling facilities and here too more development and research can be expected with some exciting results.

Déjà vu

In conclusion, it would seem that the words uttered 15 years ago by Henri Proglio, the then chairman of Veolia Environnement, over the Cleanaway deal still hold true today. Mr Proglio said: “The acquisition reinforces our position in the consolidating and fast-growing UK waste sector; it will allow us to accelerate our organic growth in the PFI and industrial sectors through an additional commercial network as well as a strengthened access to local authorities and major industrial companies. With significant revenue and cost synergies in all business lines, the acquisition provides value creative growth.”

Suez will for sure bring even more ‘value creative growth’ to Veolia.

Subscribe for free